How to use leverage in forex trading?

One of the reasons so many people are attracted to Forex trading compared to other financial products is that they can usually get much more leverage in Forex than in stocks. Many traders have heard the term “leverage,” but few are familiar with the definition of how leverage works and has a direct impact on profits.

This article will discuss leverage in Forex trading and how to use it.

Leverage in Forex Trading

Traders of stocks call this “margin trading.” When trading Forex, the margin you use has no interest, and it doesn’t matter the type of Forex trader you are or what type of credit do you own. If you have a Forex trading account and the broker offers you a margin, you can trade it.

The obvious advantage of Forex trading leverage is that you can make a fair amount of money with limited capital in Forex. The problem is that you can also lose a significant amount of money when trading with leverage. It depends on how smart you use it and how conservative your risk management is.

Trader has control

Leverage makes a sluggish market incredibly exciting, but excitement isn’t always good when it comes to your money. That’s what leverage brings to Forex. Without leverage, traders would be surprised if their accounts moved 10% in a year. However, leverage traders can easily find more than a 10% movement in a day.

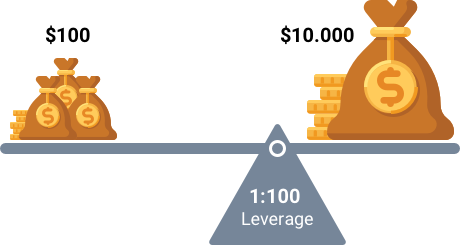

Leverage amount

Leverage is usually stated at a fixed amount and may vary from broker to broker. Each broker issues leverage based on rules and regulations. The quantities are usually 50: 1, 100: 1, 200: 1, and 400: 1.

50: 1

Fifty to one Leverage means that you can trade up to $ 50 for every $ 1 in your account. For example, if you deposit $ 500, you can trade up to $ 25,000.

100:1

100 to 1 leverage means that you can trade up to $ 100 per account. This ratio is typical leverage provided by standard lot accounts. The normal minimum deposit for a standard account is $ 2,000, and you will be allowed to manage $ 200,000.

Professional traders and leverage

Professional traders usually trade with little leverage. Keeping your leverage low helps you protect your capital and keep your bottoms constant in the event of a trading error.

Many experts use leveraged amounts such as 10: 1 or 20: 1. It is possible to trade with this type of leverage, regardless of the broker’s offers. You need to deposit more money and make fewer transactions.

Final word

Once you learn how to use the lever, you don’t have to be afraid. Leverage should not be used only when you are taking an approach to reach out to a transaction. Otherwise, with proper management,leverage can be used successfully and profitably. Like any sharp instrument, leverage should be used with caution. Once you’ve learned this, don’t worry. If you are a new trader in the Forex market looking for good brokers, please make sure to read our article on globex360 sign up.