How Will A Stock Exchange Work In 2022

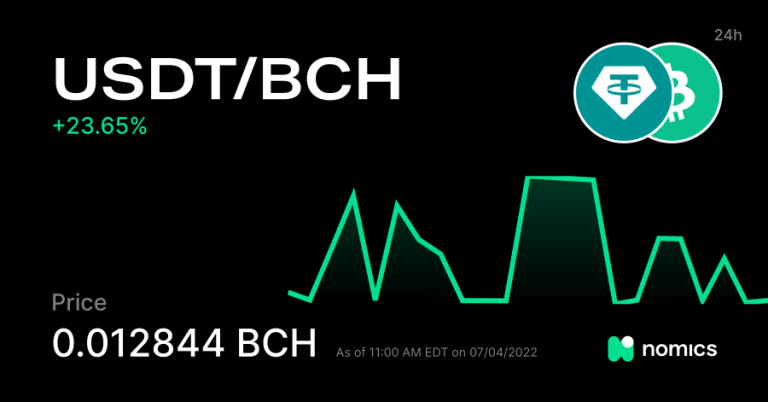

The world is changing at an unprecedented rate. Social media has given individuals access to information that they never had before. This has led to a new term known as ‘Cryptocurrency’. Cryptocurrency is digital currency that is encrypted. In other words, it can be used like cash, but it is not backed by any central bank or country. This has led to the creation of virtual stock exchanges in countries like the U.S., Europe, and Asia Pacific regions. Here’s how a stock exchange will work in 2022:

How a Stock Exchange Works in Basics

When a person wants to buy or sell stocks, he needs to find someone who is willing to trade with him. Traders can either trade stocks themselves or use a Broker. When you trade yourself, you are called a ‘Broker Dealer’. When you use a Broker, you are called a ‘Broker Dealer Dealer’. Now, let’s say you want to sell your stock. You can either sell it at the price someone has bought at or offer it at a price that you think is good. Let’s say you have $2 invested in Apple, Inc. If someone wants to buy your stock, they will first have to find a trader who is willing to sell their Apple Inc. shares. That’s how a stock exchange works in basics.

Traded Securities

Traded securities are stocks that are listed on a stock exchange. These are the stocks that you can buy, sell, and trade through an exchange. You can also hold traded securities in your brokerage account. There are different types of securities: equity, debt, commodity, and derivatives. Some examples of equity securities are stocks and mutual funds. Debt securities are usually loans, where you are the borrower and the lender is the broker. You can also hold commodity securities. These include commodities like oil and gold, which are bought and sold for money.

Liquidity & Order Books

The liquidity of a stock depends on how many people are willing to sell or buy it. It is usually measured by the ‘daily trading volume’. When there are many buyers and sellers, the price of a security is usually higher compared to when there are fewer buyers and sellers. This is because there are more competition. When you buy a stock, you are usually ‘shorting’ it. This means that you will profit when the price of the stock goes down. This is the definition of ‘shorting’:

“Shorting a stock means you borrow it first, then sell it later to profit when the price goes down.”

When you want to buy a stock, you are called an ‘immediate buyer’. This means that you will pay the price that is currently being ‘bid’ for. There are two ways of buying securities: using ‘market orders’ or ‘limit orders’. With market orders, you will just buy the quantity of stock that is currently ‘asked’. With limit orders, you buy or sell just a certain quantity of a certain stock.

Leveraged Trading

Leveraged trading is when you buy a stock that is relatively cheaper. You then use ‘margin’ to buy more stock. The amount that you are ‘margin’ that you have to put as a deposit is usually between 1% and 5% of the amount that you are trading.

Leveraged Traders will use advanced computer algorithms to trade multiple stocks at the same time. For example, if you have $100, you can buy $1,000 worth of stock. If the price of the stock goes up to $2, the trader will profit $1,000. If the price of the stock goes down to $1, the trader will have to pay $1,000. This can be repeated over and over again.

Conclusion

The stock exchange is a place where you buy and sell stocks. The price of a stock is based on the demand and supply. There are different types of stock exchanges that are designed for different purposes. You can buy and sell traded securities on a stock exchange, and you can also hold them in your brokerage account. The liquidity of a security is measured by the volume of trades that were made. The way you buy, sell, and hold stock depends on the type of exchange that you are on. A stock exchange is a place where you buy and sell stocks.

Stock Exchanges – Overview

These days, the world is becoming more and more digital. Business is no longer centralized around cities, and it is happening in the air. The stock exchange is a place where you buy and sell stocks. You can find many different types of stock exchanges.

What is a Stock Exchange?

A stock exchange is a centralized market where people trade shares. It is a centralized market because all traders are “in the same boat” and the market is “invisible”. You can trade shares and commodities like gold, oil, and equity shares.

How Does a Stock Exchange Work?

A stock exchange matches buyers and sellers of stocks. The buyer and the seller each put a “price” on their shares. This price may be a number like $100 or a dollar sign like $. This price is what the buyer must pay and it is what the seller must accept in order to have the sale completed.

The Best Stock Exchanges

There are many types of stock exchanges in the world today, such as the New York Stock Exchange, Nasdaq, and the London Stock Exchange. Although there are many advantages to each type of stock exchange, we are going to discuss the best stock exchanges based on their popularity and the trading volume.

How to Trade Stocks on the New York Stock Exchange

The New York Stock Exchange is one of the most popular stock exchanges in the world today. It is located in New York City and is operated by the New York Stock Exchange Inc.

How to Trade Stocks on the Nasdaq

The Nasdaq is a leading technological innovation exchange. It has many different types of securities, including stocks, bonds, and commodities. The Nasdaq is owned by a private company that operates the exchange.

How to Trade Stocks on London Stock Exchange

The London Stock Exchange is a very old stock exchange that is now owned by the London Stock Exchange Group PLC. It is located in London, England and is a great place to trade in Europe.

Conclusion

Cryptocurrency is a new type of virtual money that is becoming more and more popular. People can buy and sell cryptocurrency through virtual stock exchanges. These exchanges are decentralized and are not controlled by any government or bank.

These stock exchanges are called decentralized exchanges. They are much safer than centralized exchanges because they are not controlled by any one person or group. Cryptocurrency is much more likely to survive than any form of paper money.

Stock Exchanges – Overview

Today, the world is becoming more and more digital. Business is no longer centralized around cities, and it is happening in the air. The stock exchange is a place where you buy and sell stocks.